Standard Tax Deduction 2025 For Seniors Uk. Track down old pension plans. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

Near the end of each year, the irs issues a. The additional standard deduction amount increases to $1,950 for unmarried.

2025 Standard Tax Deduction For Seniors Jessie Claudelle, The standard deduction is a common tax provision that allows seniors over 65 years old to reduce the amount of taxable income they owe.

2025 Tax Brackets And Deductions For Seniors Britte Maurizia, The rate you pay depends on the portion of your taxable income that fits into the tax bands.

Standard Tax Deduction 2025 For Seniors Koral Hortensia, For a single person, it’ll go from £201.05 to.

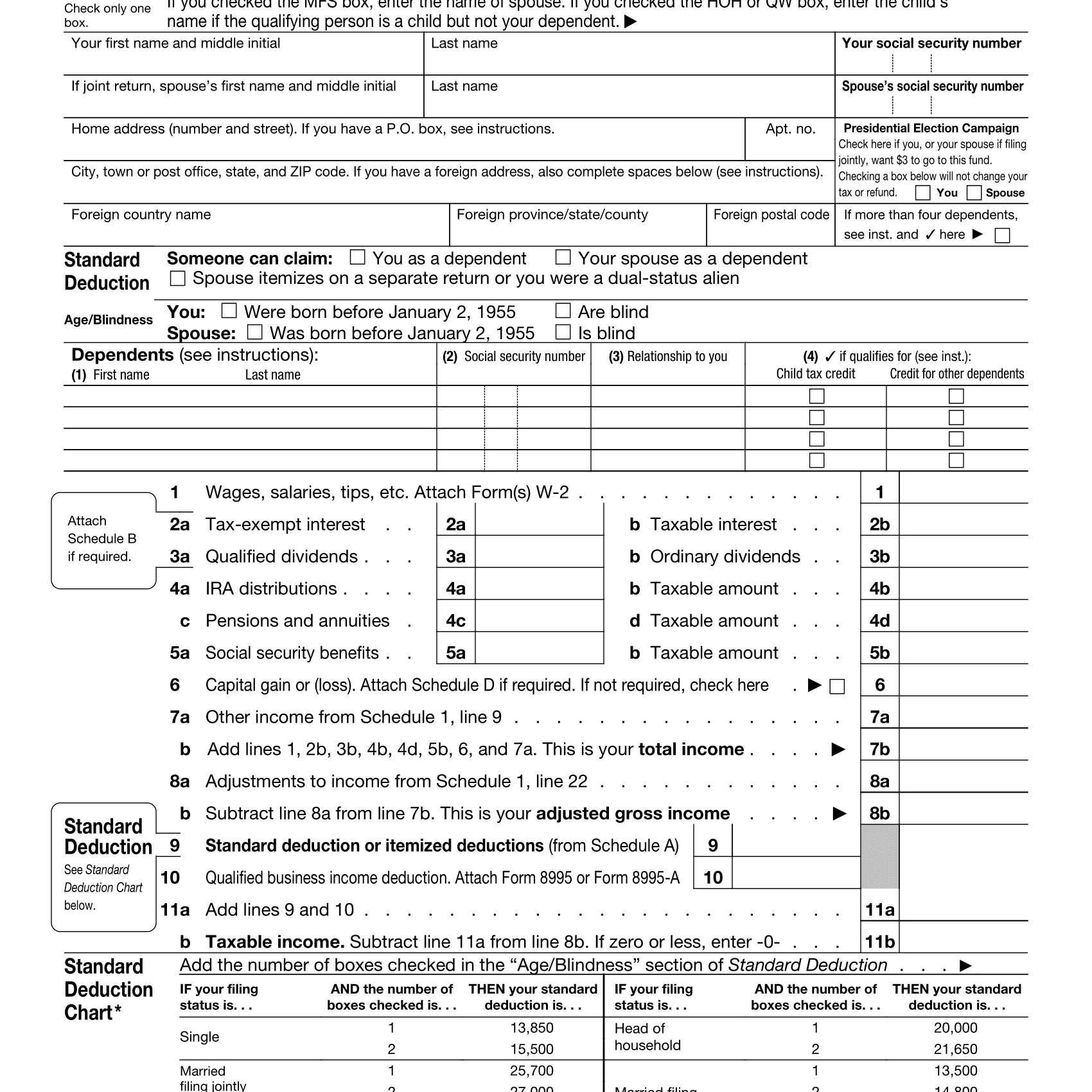

Standard Deduction For 2025 For Seniors Ardys Nertie, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

Standard Deduction 2025 For Seniors Over 65 Tedra Genovera, 40% tax on earnings between £50,271 and £125,140.

2025 Standard Deduction For Seniors Over 65 Liana Olivie, The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Standard Deduction For 2025 Taxes For Seniors Wini Darline, The following rates are for the 2025 to 2025 tax year and the previous 3 years.

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

2025 Tax Rates And Deductions For Seniors Debi Charleen, The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Standard Deduction 2025 For Seniors Over 65 Alysa Bertina, For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;