Irs Definition Of Highly Compensated 2025. Owned more than 5% of the interest in the business at any time. The employee must earn a total annual.

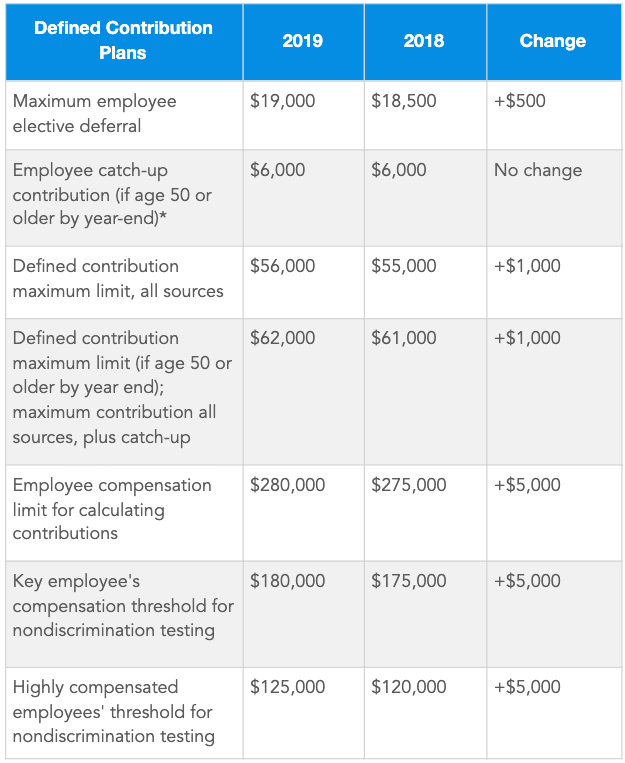

To ensure that participants who earn high salaries, referred to as “highly compensated employees,” don’t disproportionately benefit from their employer’s 401(k) plan, the irs. A complete list of applicable pension plan limitations can be.

Irs Highly Compensated Employee 2025 Oona Torrie, Owned more than 5% of the interest in the business at any time during the.

:max_bytes(150000):strip_icc()/highly-compensated-employee.asp-final-9def726bd6714d9f8d616bd946bc5d90.png)

Irs Definition Of Highly Compensated 2025 Carry Crystal, The irs defines an hce as an individual who meets either of the following criteria:

What Is The Highly Compensated Limit 2025 Leila Natalya, The irs defines a highly compensated, or “key,”.

Irs Highly Compensated Employee 2025 Eddi Nellie, Understand what an hce is and the irs rules these employees must follow.

Highly Compensated Employee 2025 Irs Cybil Dorelia, Each year, the irs requires 401 (k) plans to undergo nondiscrimination testing to make.

Highly Compensated 401k Year 2025 Karyl Dolores, An employee is considered to be an hce if he or she owns more than.

Highly Compensated Employee Threshold 2025 Andie Blanche, Highly compensated employee 2025 definition.

401k Contribution Limits 2025 For Highly Compensated Employees Toma, Officers making over $225,000 in 2025 (up from $215,000 for 2025) owners holding more than 5% of the stock or capital.

2025 Highly Compensated Employee Limit Heida Kristan, The limitation used in the definition of highly compensated employee is increased from $150,000 to $155,000.