Hmrc Pension Lump Sum Warning 2025 Calculator. Review your results and compare them to taking. Use our pension lump sum and tax calculator to see how withdrawing a lump sum or investing in your pension could affect your retirement plans and the tax you’ll pay.

The two new allowances are: Check what you need to do when taking lump sums so you know what’s tax free.

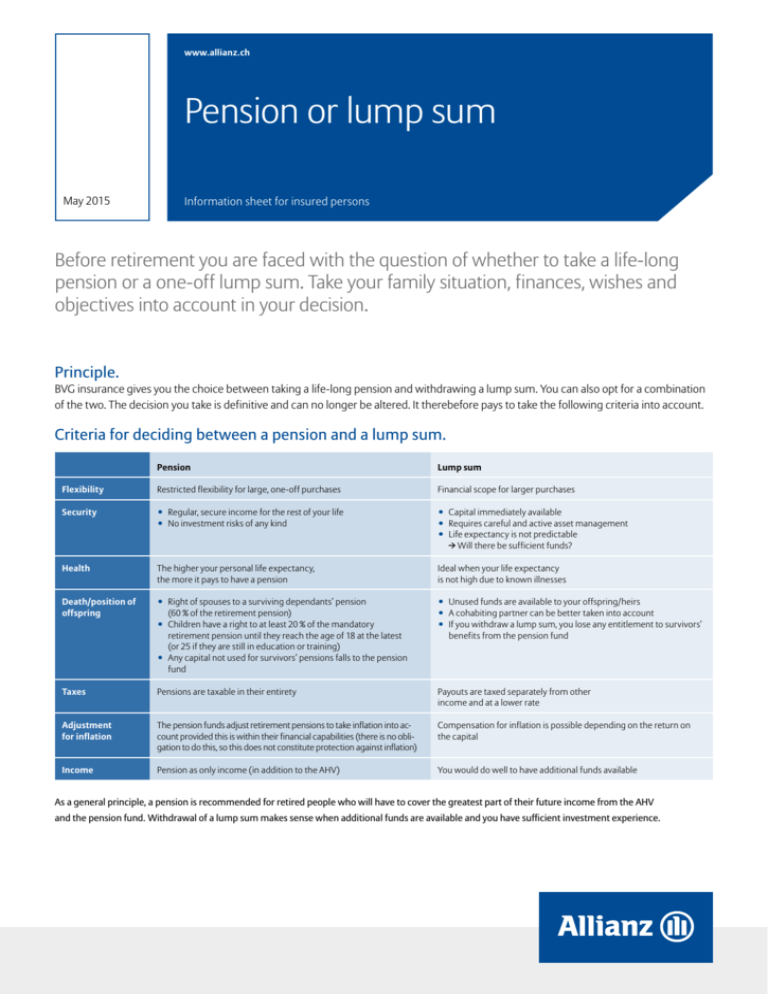

Pension or lump sum, For pensioners receiving tax demands, hmrc advises that payment is due by january 2025.

HMRC breaks silence over lump sum pension rules and says 'no, Use our pension lump sum and tax calculator to see how withdrawing a lump sum or investing in your pension could affect your retirement plans and the tax you’ll pay.

How To Calculate Lump Sum Pension Payout? Retire Gen Z, Replaced employment status indicator with 'check your employment status for tax' service.

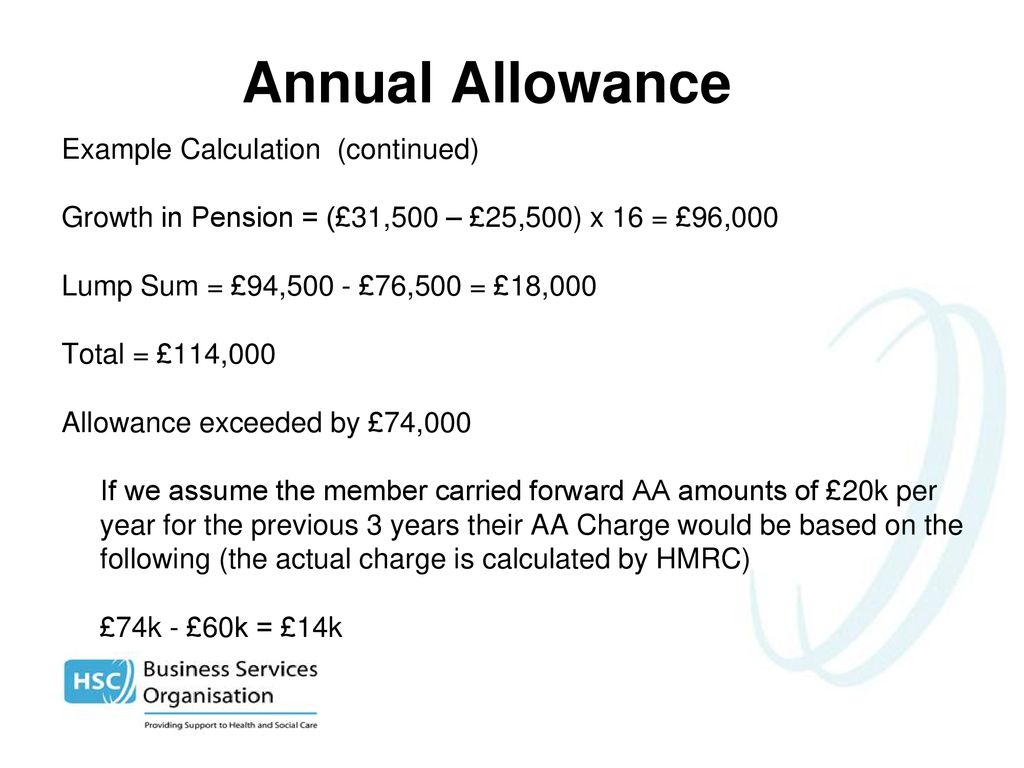

Local Government Pension Scheme ppt download, Check what you need to do when taking lump sums so you know what's tax free.

How To Calculate Lump Sum Pension Payout? Retire Gen Z, Following the announcement in the spring budget 2025 that from april 6, 2025, the lifetime allowance charge would be removed, and fully abolished from the 2025 to 2025 tax.

New Lump Sum Tax Allowances under Registered Pension Schemes Fieldfisher, The lump sum must be tested against their lump sum allowance at the time the lump sum was paid from their pension scheme. with rumours swirling about a potential cap on tax.

Pension Lump Sum Interest Rate 2025 Reba Madeleine, Following the announcement in the spring budget 2025 that from april 6, 2025, the lifetime allowance charge would be removed, and fully abolished from the 2025 to 2025 tax.

Social security lump sum calculator ChindaSeosamh, Depending on your pension provider, the amount in your pot, and various other factors, you may still be able to protect your lifetime allowance with hmrc.

1995/2015 Scheme + HMRC Rules ppt download, Check with your provider about how you can take money from a defined contribution pension.