Fsa Limit 2025 Family Contribution. The irs announced that 2025 hsa contribution limits will increase to $4,300 for. The maximum amount of money you can put in an hsa in 2025 will be.

This allowance provides for the basic living expenses of a. The 2025 contribution limit for limited purpose fsas is also $3,050 and $3,200 in 2025.

The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750.

Fsa Limits 2025 Carryover Limit Nyssa Arabelle, The maximum amount of money you can put in an hsa in 2025 will be. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Fsa Contribution Limits 2025 Family Codi Marney, Irs increases fsa limits for 2025. The irs announced that 2025 hsa contribution limits will increase to $4,300 for.

Irs Fsa Max 2025 Joan Ronica, If you and your spouse are both offered an fsa through your employer,. Payments can be as low as $0 for people.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Individuals can now contribute up to $4,150, while families can set aside $8,300. This represents a 6.7% increase in 2025 over a year.

IRS increases FSA contribution limits in 2025; See how much, For 2025, the minimum deductible for a family health plan will be at least $3,200, up from $3,000 in 2025. Our bulletin breaks down the 2025 health fsa contribution limits issued by the irs for health plan sponsors and plan participants.

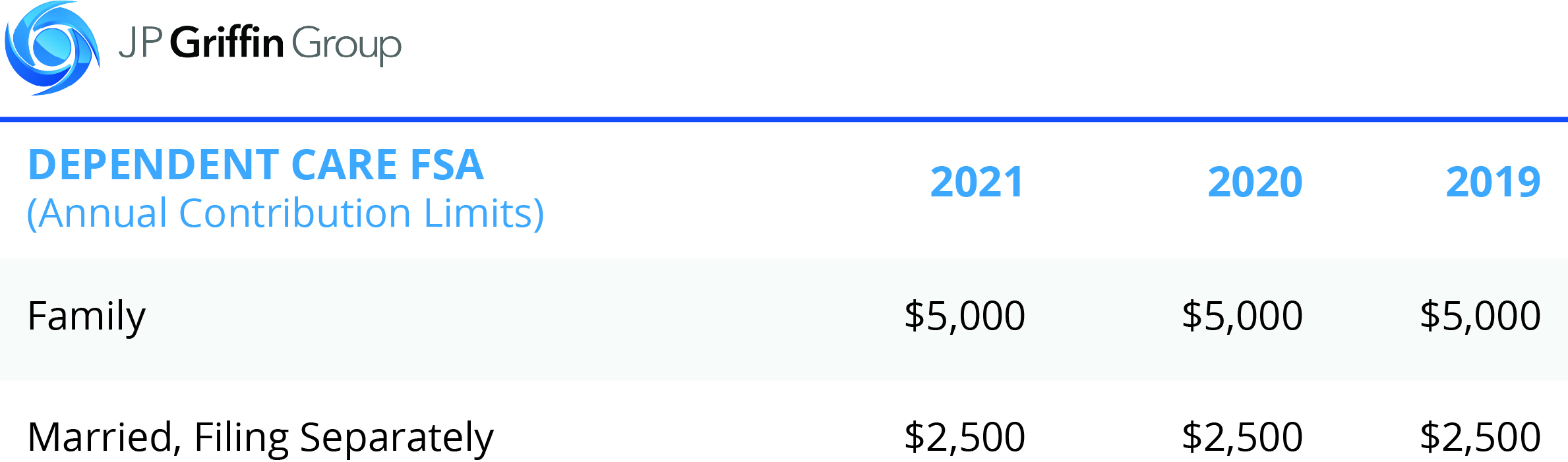

Fsa Limit 2025 Genni Jacinda, Dependent care fsa limits for 2025. The irs announced that 2025 hsa contribution limits will increase to $4,300 for.

FSAHSA Contribution Limits for 2025, Our bulletin breaks down the 2025 health fsa contribution limits issued by the irs for health plan sponsors and plan participants. For 2025, there is a $150 increase to the contribution limit for these accounts.

What To Know About the New 2025 HSA And FSA Contribution Limits, For 2025, the minimum deductible for a family health plan will be at least $3,200, up from $3,000 in 2025. Here are the new 2025 limits compared to 2025:

2025 Contribution Limits Announced by the IRS, Fsas only have one limit for individual and family health. The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750.

IRS Raises 2025 Employee FSA Contribution Limit to 3,200 NTD, For 2025, there is a $150 increase to the contribution limit for these accounts. Dependent care fsa limits for 2025.